Francisco A. Laguna & Wojciech Kornacki

Under normal conditions, a country with a well-educated population, a large middle-class, 9% of proven world oil reserves, 18% of proven global gas reserves and an abundance of strategic minerals would be an excellent place to invest. Unless, the country is Iran, which is currently subject, rightly, to complex and multi-faceted international financial and other sanctions that have reduced its economy by about 15 to 20%. This may change soon, however, as Iran attempts to end its economic isolation.

According to a 2007 Goldman Sachs report, Iran’s energy sector, technology, and human capital could make it particularly attractive for foreign direct investment. Now that there is a possibility that sanctions may be lifted, many national and private investors want to position themselves to benefit from the new and very attractive market when (and if) it opens. Countries such as China, Russia, Turkey and various European countries are already preparing for the sanctions to be lifted.

Currently, the United States and Iran are engaged in extensive negotiations over Iran’s nuclear program. Depending on the outcome, certain sanctions could be lifted against Iran. This would open its oil, gas, technology, human resources, natural resources, automotive, airline, hospitality and tourism, and many other industries to foreign direct investment, and it would create billions of dollars’ worth of business opportunities in Iran and the world. Courtesy of http:// http://en.wikipedia.org

The expectation is that once sanctions are removed, new opportunities will create billions of dollars’ worth of business for local and international companies. Essentially, Iran could be the “next big thing” (once the sanctions are lifted) after the opening of the markets in Central and Eastern Europe. Some of its regional trading partners expect that their economies will also grow once the sanctions are removed.

Investors are already holding discussing Iran’s oil industry and auto industry. Indeed, many international energy companies are very interested in Iran, including Royal Dutch Shell Plc, British Petroleum and Total SA.

Not all sanctions will be lifted overnight, and some sanctions may continue for years to come. In addition to keeping an eye on the international sanction regime, a prudent investor should also consider the following Iranian industries, once the sanctions are removed.

Banking: New businesses and residents will require both domestic and international banking services. The international banking community has started looking at the country’s potential. It will be interesting to see which banks move in first. Will the Swiss join?

Iran’s domestically developed drone capable of traveling almost 2,500 miles. Due to sanctions, Iran has been forced to develop its own technologies. Collaboration between international and domestic businesses partners is estimated to create millions of dollars’ worth of business, once the sanctions are lifted. Courtesy of http:// http://en.wikipedia.org

Construction / Real Estate: Many Middle Eastern businesses are interested in Iran’s real estate market. The lifting of sanctions is likely to result in the return of some of the Iranian diaspora as well as representatives of multinationals and other companies that will invest in the country. This will create the need for housing and, as the economy progresses, more luxury condominiums and residences with Western amenities.

Consulting Services: International businesses are likely to begin working to pre-position themselves in a post-sanctions Iran. To be successful in the country, businesses will need reliable consultants to assist them navigate cultural nuances, language barriers and business practices, including the practice of gift-giving.

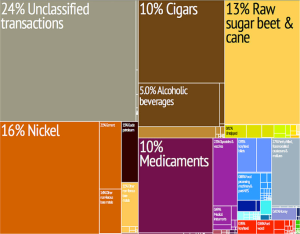

Natural Resources and Minerals: After years of sanctions, Iran desperately needs billions of dollars to make its oil industry profitable again. In 1974, Iran pumped 6 million barrels per day; today, it only pumps 2.8 million.

: Cube of Zoroaster. Iran’s rich culture spans over thousands of years.

This tower-like construction was in the 5th Century BC. Iran’s tourism and industry are likely to grow fast once the sanctions are removed. Courtesy of http:// http://en.wikipedia.org

Tourism and Hospitality: Before the Iranian Revolution, Tehran was touted as one of the most cosmopolitan cities in the region. Years of isolation and religious extremism have crippled Iran’s tourism and hospitality sectors. As Iran seeks to re-open itself to the world, it will have to modernize these sectors, and FDI is the perfect means of accomplishing this goal. There is much work to be done, however, for these sectors to be viable contributors to the Iranian economy. Currently, tourism in Iran accounts only for 2% of the entire GDP; in most countries, it is typically around 5%.

It will be interesting to see how the government will approach FDI in strategic sectors such as banking, minerals, natural gas and oil, as well as non-strategic sectors. How will it allow such investments to be structured? What ownership percentage will be permitted? What about repatriation of capital / profits or termination of investments? How will corruption manifest itself? Equally important, how will it treat different religious views and cultural morés?

If sanctions are lifted, Iran will be an emerging economy. It will not have the bargaining power of economies such as China that can exact concessions from investors. The manner in which the government treats international investors will largely determine the success of a post-sanctions Iran. Given the political and religious turmoil plaguing the larger region and the very real threat of terrorism, corporations will be cautious of investing financial and human resources for a deal that is overly burdensome with uncertain financial returns.

If you are interested in learning more about future business opportunities in Iran and how to increase your chances of harnessing them, contact TransLegal or call 703-566-9427.